b&o tax rate

If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5 of the tax for the first month or fraction thereof of delinquency and one percent 1 of the tax for each succeeding month or fraction thereof of delinquency. Washington State BO tax is based on the gross income from business activities.

So for example if you pay ServiceOther B O annually and your annual business income is.

. Business Occupation BOTax. Algona 253 833-2897 000045 000045 000045 000045 10000 40000. Auburn 253 876-1923 0001 0001 00015 00018 500000.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. Most businesses fall into the 110 of 1 rate including Retail. Utility Fund Tax.

The BO tax rate varies by classification. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes.

Listed below is a breakdown of the current tax rate schedule for the Citys Business Occupation BO Taxes. Gross Receipts Value Production. All persons engaging in business activities in the City of Charleston are subject to the BO Tax unless specifically exempted by Chapter 110 Article II Section 110-63 of the Code of the City.

Limestone or Sandstone quarried or mined blast furnace slag 150. 32 rows B. What are the penalties for unpaid BO Tax.

8 rows How much is the BO tax. 15 gross proceeds any business charging for commercial parking. Once you know which classification your business fits into you can find the rate that corresponds to your classification on our list of BO tax rates.

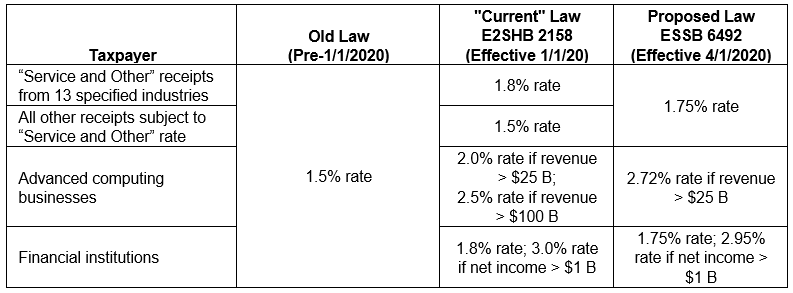

Beginning with business activities occurring on or after January 1 2020 HB 2158 will impose an increase to BO tax surcharges for the Services and Other Activities classification increased rate from 15 to 18 for any person primarily engaged within Washington in any combination of over 40 enumerated activities. The additional tax is imposed at a rate of 12 of gross income taxable under the Service and Other Activities classification thus making the effective BO tax rate for these institutions 27. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent.

Sumner does not have a BO tax over and above the State tax. 3 rows Classification Tax Rate 0471. BO Tax Rates Classification Rate Manufacturing 00011 PrintingPublishing 000153 Processing For Hire Extracting for Hire 000153 Retailing 000153 Retail Service 0004 Service Other PrintingPublishing0004 Wholesaling 000102 Late Filing Penalties If a tax return is paid within one month following the due date the.

Aberdeen 360 533-4100 0002 0003 e 00037 e 0003 e 5000 20000. The additional 3 is referred to as Workforce. If a taxpayer had taxable income of 1 million or more in the prior calendar year they will be subject to a 175 BO tax rate.

If youre not sure of your classification see our tax classifications for common business activities page or our list of tax classification definitions. To support and maintain the existing level of the Citys general governmental services the City of Auburn has adopted a Business and Occupation BO Tax which goes into effect January 1 2022. The gross receipts BO tax is primarily measured on gross proceeds of sales or gross income for the reporting period.

If your business grosses 250000 in Bremerton during 2019 you would list 250000 as your gross revenue then deduct the allowed exemption of 200000 from the gross. Every person firm association or corporation doing business in the city is subject to the business and occupation tax. Local business occupation BO tax rates.

Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax. For more information please see the City of Renton Business and Occupation Tax Guide or Renton Municipal Code RMC. Heres what the BO tax looks like for your business.

For example the 2019 retail B O tax rate is 000125 125. Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications.

Business and Occupation Tax. Potential BO Tax 4710. Businesses that are required to pay BO tax do not pay the Per Employee Fee.

6 paid by utility customers on their water-sewer utility the refuse utility and the storm sewer utility. Sand Gravel or other mineral not quarried or mined and oil blast furnace slag 300. Extracting Extracting for Hire00484.

BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be. Although there are exemptions every person firm association or corporation doing business in. To calculate this amount multiply your taxable gross revenue amount by the tax rate.

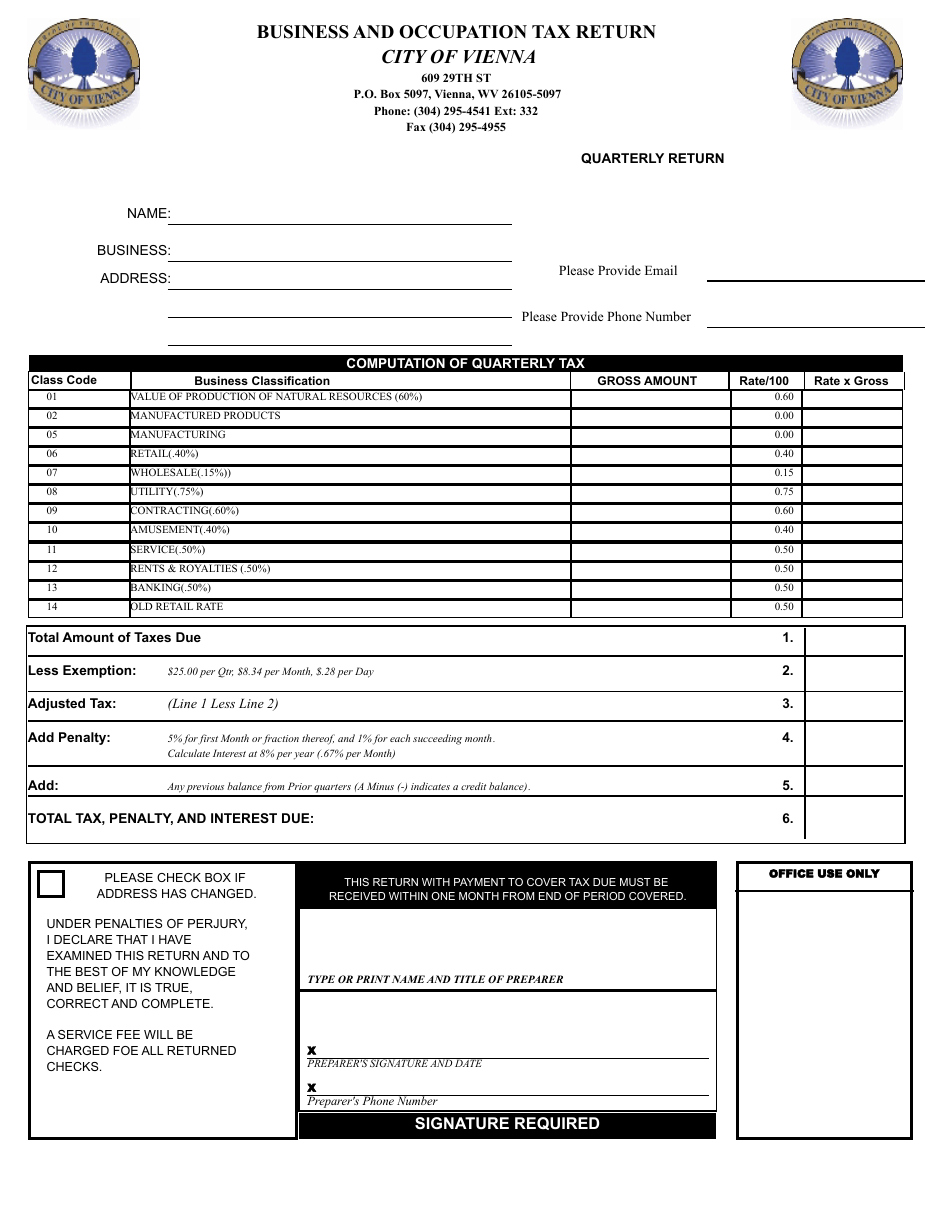

City Of Vienna West Virginia Business And Occupation Tax Return Download Fillable Pdf Templateroller

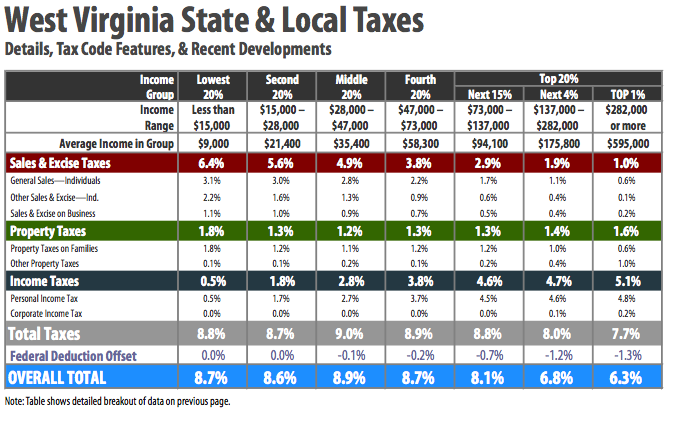

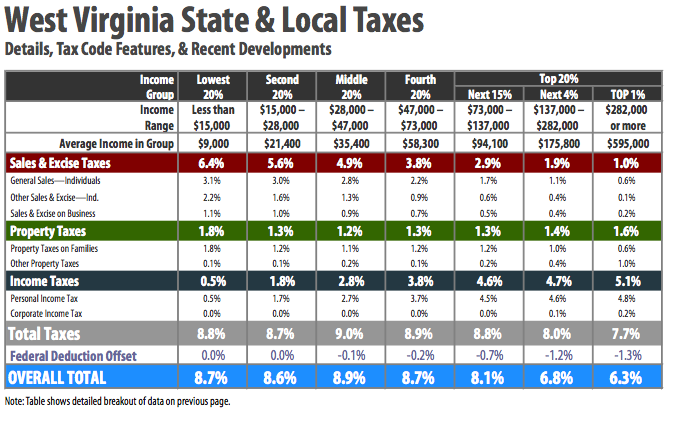

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Am I Taxed Too Much Understanding The Impacts Of Fiscal Policy Washington State Wire

B Amp O Tax Return City Of Bellevue

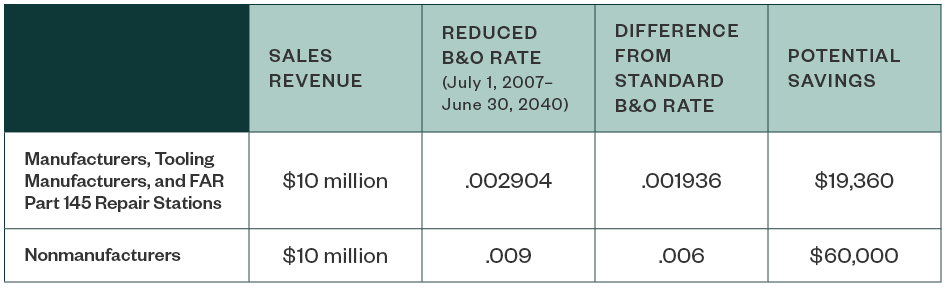

Washington Aerospace Tax Incentives

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

B Amp O Tax Guide City Of Bellevue

A Guide To Business And Occupation Tax City Of Bellingham Wa

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

City Of Tumwater B O Fill Online Printable Fillable Blank Pdffiller

Business And Occupation B O Tax Washington State And City Of Bellingham

B Amp O Tax City Of Bellingham

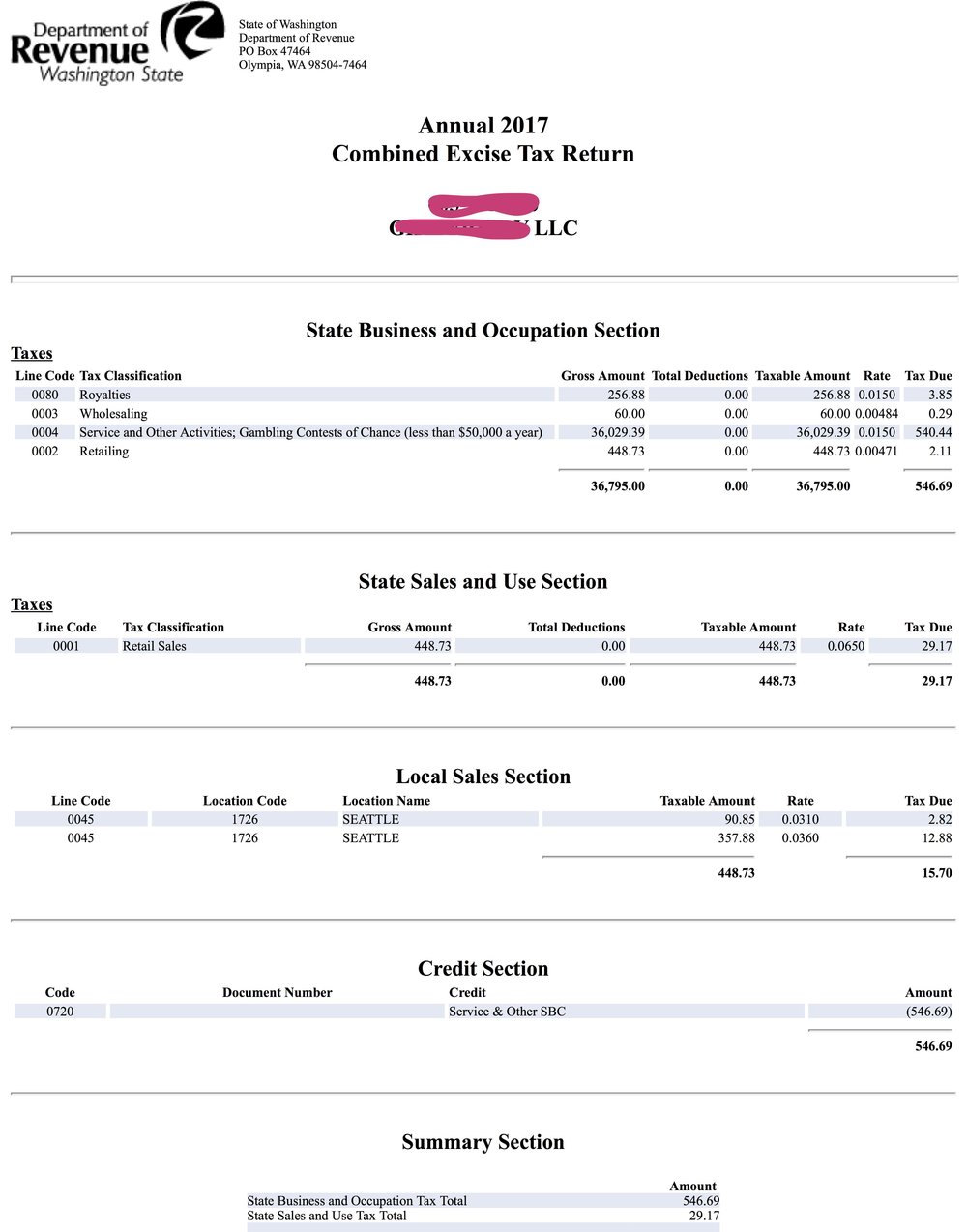

Wa Dor Combined Excise Tax Return 2020 2022 Fill Out Tax Template Online

Business License Tax Seattle Business And Occupation Tax B O Tax Community Business Services Inc Tax And Accounting